geothermal tax credit form

Central Air Systems Inc. SEER 17 and HSPF 10.

How To File Irs Form 5695 To Claim Your Renewable Energy Credits

For installations during these earlier years the credit did not require an award and the taxpayer could claim the credit if eligible on the IA 148 Tax Credit Schedule filed with the individual.

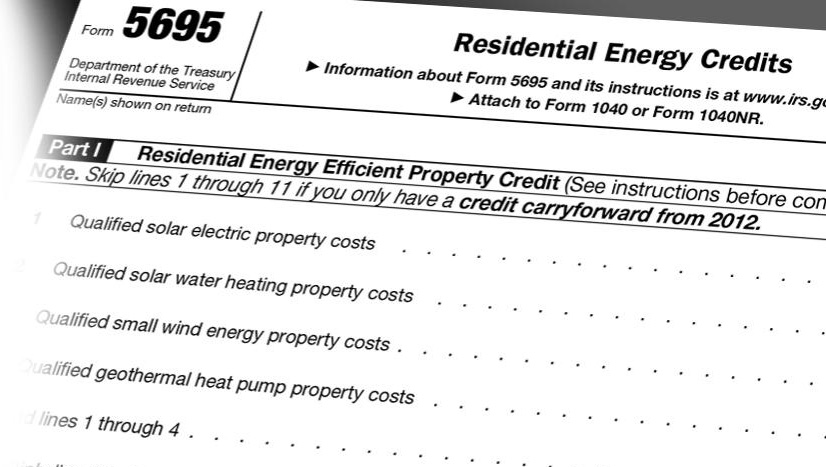

. When submitting a tax return file Form 5695 under Residential Energy Credits to get credit for your geothermal heat pump. One reason why geothermal heat pump systems are so popular is because of their federal and state incentives. This Tax credit was available through the end of 2016.

Homeowners who install geothermal can get the tax credit simply by filling out a form declaring the amount you spent when you file your federal income taxes. Air Source Heat Pumps. As long as your.

It is an amount that is applied to your tax liability what you owe to the IRS in order to reduce or eliminate what. Name A - Z Sponsored Links. Use Form 5695 to figure and take your.

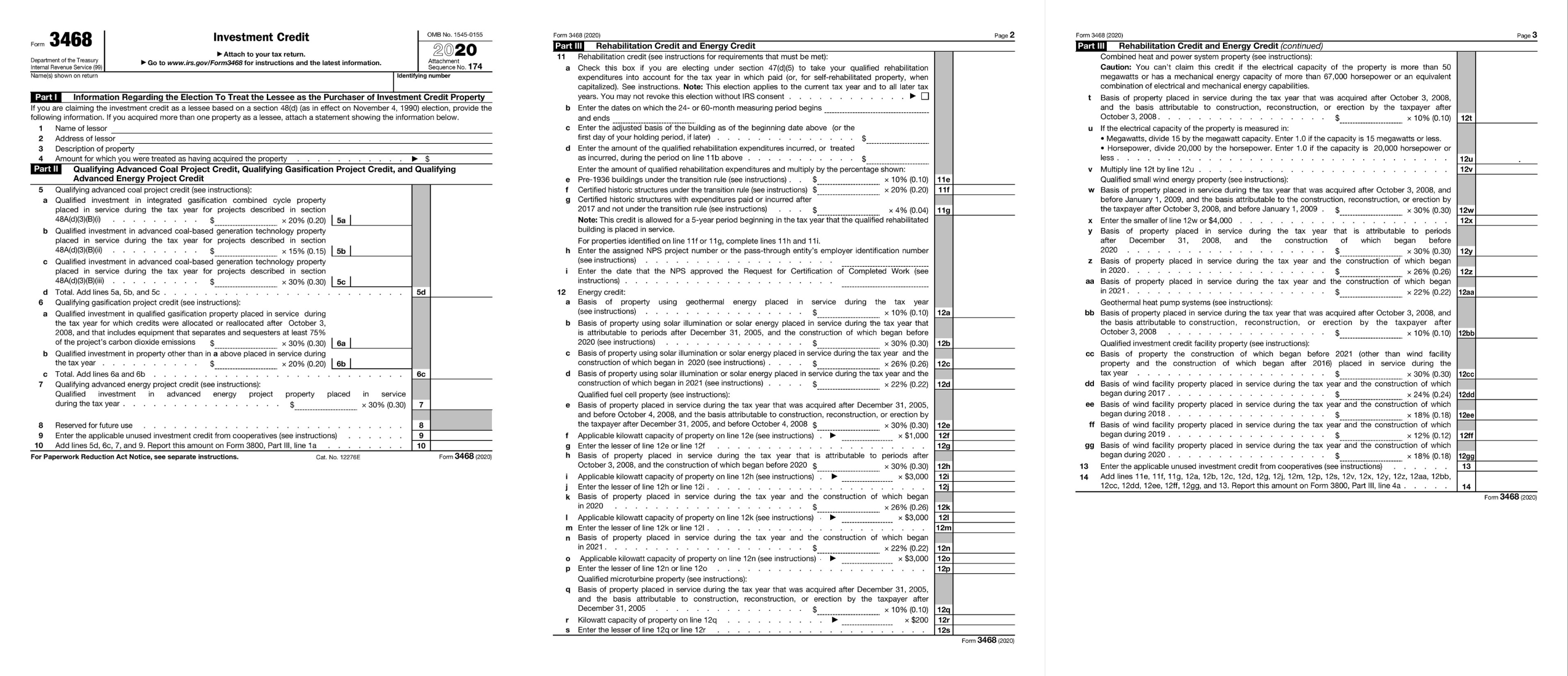

Tax deductions for energy efficient commercial buildings allowed under Section 179D of the Internal Revenue Code were made permanent under the Consolidated. Otherwise geothermal heating is much more efficient than air source or other electric heat. You may not claim this credit after Tax Year 2021.

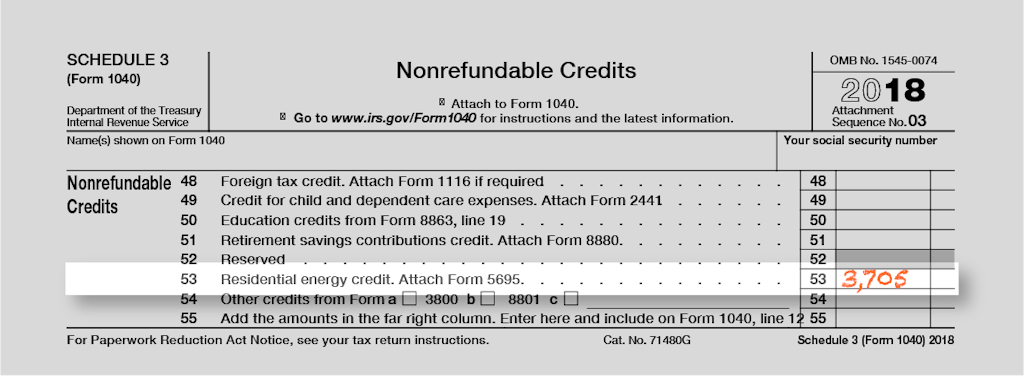

SEER 16 EER 13. The Geothermal Tax Credit is classified as a non-refundable personal tax credit. In August 2022 the tax credit for geothermal heat pump installations was extended through 2034.

SEER 14 EER 12. Geothermal Heating Cooling. The IRS issues federal tax credits themselves.

Quick steps to complete and e-sign Fillable Online Understand The Geothermal Tax Credit online. For residential customers geothermal provides a 30 tax credit which. SEER 16 and HSPF 85.

Heat pumps that are ENERGY STAR certified. Geothermal heating and cooling requires no burning of fossil fuels at the heating. Equipment Type Efficiency Requirements Customer Rebate.

Beginning January 1 2016 an individual taxpayer who owns geothermal machinery and equipment for use in their residence may claim an Income Tax credit of 25 of the cost of. Information about Form 5695 Residential Energy Credits including recent updates related forms and instructions on how to file. Geothermal equipment that uses the stored solar energy from the ground for heating and.

Use Get Form or simply click on the template preview to open it in the editor. A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009. Geothermal System Credit Form ENRG-A This credit was repealed by the 2021 Montana State Legislature.

Attach to Form 1040. Geothermal Heating in Medford NY. Form 5695 2021 Residential Energy Credits Department of the Treasury Internal Revenue Service Go to wwwirsgovForm5695 for instructions and the latest information.

Tax Forms Irs Tax Forms Bankrate Com

Can You Claim Window Replacement On Taxes

How To Claim The Solar Tax Credit Boston Solar Ma

Federal Investment Tax Credit Itc Form 3468 3468i Eligible Ineligible Ysg Solar Ysg Solar

Save Money With The Federal Solar Tax Credit And Other Renewable Energy Incentives

Home Energy Tax Credits For Property Efficiency And Tax Savings

How To Claim The Federal Solar Tax Credit Savkat Inc

Federal Tax Credit Extended For Home Window Films Installed In 2021

Claiming The Tax Credit About Irs Form 5695 Remodeling

Form 5695 Claiming Residential Energy Credits Jackson Hewitt

Learn About The Solar Tax Credit

Residential Energy Efficient Property Credit Qualification Form 5695 How To Claim

How Do I Claim The Solar Tax Credit Itc Form 5695 Instructions

10 Tax Breaks You May Be Overlooking Newsnation

Solatube Tax Credit Info Daylighting System Solar Powered Fan

What The Inflation Reduction Act Means For The Geothermal Federal Tax Credit

Here S How To Claim The Solar Tax Credits On Your Tax Return Southern Current